The more dog washes they do, the higher that bill. But a dog grooming business that uses water to provide their service would almost certainly consider the water bill a variable cost. A consulting business with a traditional office space may consider the water bill, for example, a fixed cost. The division between fixed and variable costs can depend largely on your business.

Ratios and price per unit calculator software#

Whether you have a great month or a terrible month, you’ll still need to pay all your software subscriptions, rent, and phone bills. So if variable costs go up or down depending on how your business does that month, what are fixed costs? Fixed costs are, as the name implies, relatively static.

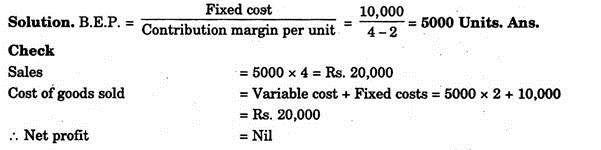

The shampoo is a variable cost in this scenario.Ĭommon examples of variable costs include:ĭifference Between Fixed & Variable Costs For example, if you run a dog grooming salon and have a strong month with more pups than normal stopping by, you’ll need to buy more shampoo to keep up with demand. Variable costs, generally speaking, are those expenses that fluctuate from month to month, usually in direct relation to your sales. So finding your variable costs may involve adding up all the relevant line items from your income statement and then subtracting that amount from your net sales. Instead, they’re usually listed as line items within cost of goods sold, right alongside fixed costs. Variable costs also live on the income statement, but they’re not as easy as net sales to find. It’s usually the first thing you see on an income statement before all expenses are taken out to get to the “bottom line.” Variable Costs It’s all the money your business brought in, excluding only allowances and returns. Net sales is often referred to simply as revenue. The two primary variables here are net sales and variable costs, both of which can be found on an income statement. Net Sales – Variable Costs = Contribution Margin

The formula for contribution margin is simple and just involves a little subtraction.

The overarching goal of the contribution margin to help these key players improve the production process by analyzing their variable costs and (hopefully) finding ways to bring them down. It’s a metric that’s rarely shared publicly but rather is used by managers and leadership to make decisions. One metric to keep an eye on, particularly for businesses that produce physical products, is contribution margin.Ī business’ contribution margin shows how much money is left over after variable costs are removed to cover fixed costs. And the things you’re doing now may not continue to work as the business grows. When taking a look at how your business is doing financially, it’s tempting to focus all your attention on the “bottom line.” In other words, are you turning a profit or not? If the answer is yes, many business owners might stop there, pat themselves on the back, and vow to keep doing more of the same.

0 kommentar(er)

0 kommentar(er)